How Do I Write Off Bad Debt Expense Journal Entry: A Simple Guide

Accounting For Bad Debts (Journal Entries) – Direct Write-Off Vs. Allowance

Keywords searched by users: How Do I Write Off Bad Debt Expense Journal Entry Bad debt expense, Write-off Bad Debt là gì, Provision for bad debts, Under the allowance method, writing off an uncollectible account, Write off entry, Depreciation expense journal entry, Allowance for doubtful accounts debit or credit, Write off transaction

What Is The Journal Entry For Bad Debts Return Off?

Journal Entry for Recovered Bad Debts

A journal entry for the recovery of bad debts is a crucial accounting transaction used to account for income that was previously considered uncollectible but has now been received. This entry represents the reversal of a loss previously recognized in the company’s financial records. To make this journal entry, you should:

-

Debit the Bank Account (Asset Account): This step increases the company’s assets because it represents the cash received from the debtor who had previously defaulted on their payment.

-

Credit the Bad Debts Recovery Account (Income Account): By crediting this income account, you recognize the recovered amount as revenue, offsetting the initial loss.

This journal entry serves to reflect the financial improvement resulting from the collection of previously written-off bad debts. It not only boosts the company’s cash position but also positively impacts its profitability. For example, on May 13th, 2022, you would make this entry to accurately reflect the recovery of bad debts.

How Are Bad Debts Written Off Treated In Accounting?

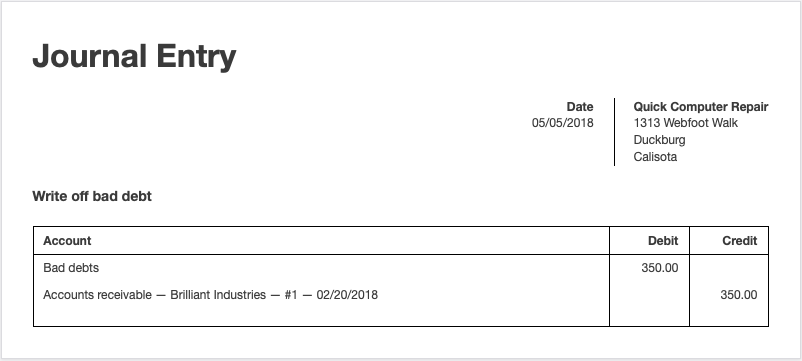

How are bad debts handled in accounting, specifically in the context of the direct write-off method? When a company decides to write off a bad debt, it records this event by making two journal entries. Firstly, a debit entry is made to the ‘Bad Debt Expense’ account. This debit reflects the recognition of the financial loss due to the uncollectible debt. Secondly, a credit entry is made to the ‘Accounts Receivable’ account, effectively reducing the amount of outstanding receivables.

It’s important to note that the direct write-off method does not involve maintaining an allowance for doubtful accounts. Instead, it directly writes off the specific receivable that is deemed uncollectible. Unlike methods that utilize an allowance, the direct write-off method requires only one journal entry to remove the uncollectible amount from the accounts. This simplifies the accounting process and can be executed at the time the debt is determined to be uncollectible, rather than waiting for a specific accounting period.

For example, on August 4, 2023, a company might decide to write off a bad debt using the direct write-off method. In this case, they would debit ‘Bad Debt Expense’ and credit ‘Accounts Receivable’ to accurately reflect the financial impact of the uncollectible debt.

Aggregate 31 How Do I Write Off Bad Debt Expense Journal Entry

Categories: Top 88 How Do I Write Off Bad Debt Expense Journal Entry

See more here: tfvp.org

To record the bad debt entry in your books, debit your Bad Debts Expense account and credit your Accounts Receivable account. To record the bad debt recovery transaction, debit your Accounts Receivable account and credit your Bad Debts Expense account.Summary for Bad Debts Recovered Journal entry

Bad debts recovered entry is to record the income receivable from already recorded bad debt. So, it’s a recovery from a loss asset. So, we will debit the bank account (asset account) and Credit to the bad debts recovery account (income account) in the journal entry.The entries to post bad debt using the direct write-off method result in a debit to ‘Bad Debt Expense’ and a credit to ‘Accounts Receivable’. There is no allowance, and only one entry needs to be posted for the entry receivable to be written off.

Learn more about the topic How Do I Write Off Bad Debt Expense Journal Entry.

- Your Go-to Bad Debt Recovery Guide – Patriot Software

- Bad Debts Recovered Journal entry – CArunway

- Bad Debt Expense Definition and Methods for Estimating – Investopedia

- Adjustments to financial statements| Students – ACCA Global

- What Is the Journal Entry for Bad Debts?

- How to Write Off Bad Debt – Patriot Software

See more: blog https://tfvp.org/category/science