What Is Fisher Effect Used For In Finance?

What Is The Fisher Effect?

Keywords searched by users: What is Fisher effect used for Fisher effect formula, Fisher effect là gì, The Fisher effect says that, International Fisher Effect, Fisher equation, the international fisher equation states that:, If the IFE theory holds that means that covered interest arbitrage is not feasible, Fisher effect wiki

What Is The Purpose Of The Fisher Equation?

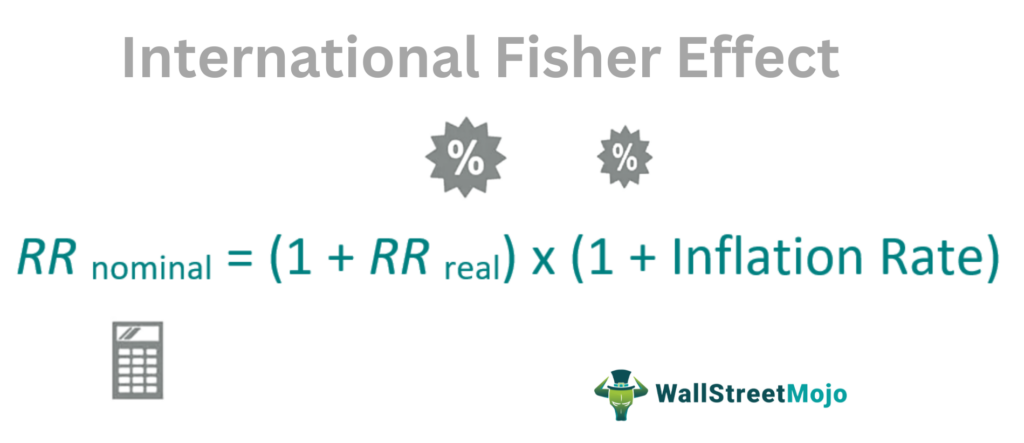

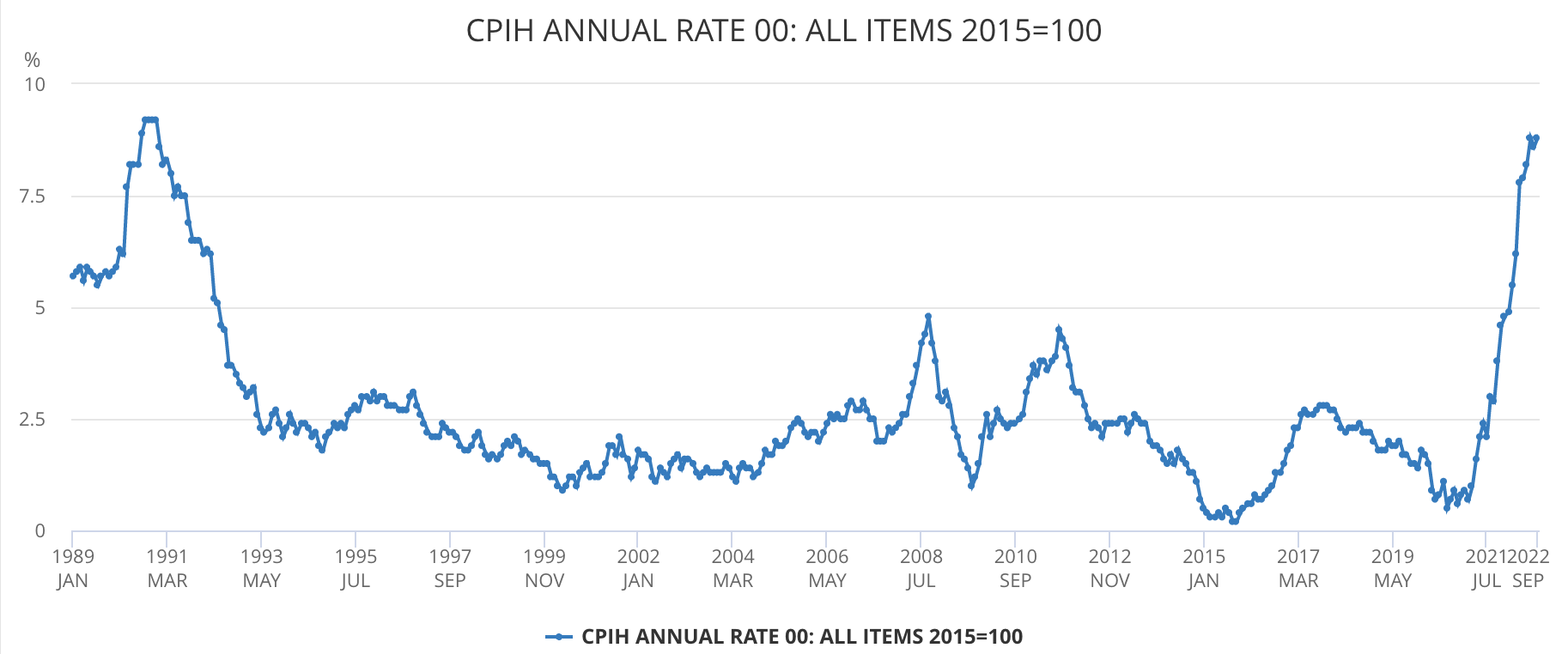

The Fisher equation is a fundamental concept in economics that helps us understand how nominal and real interest rates are interconnected in the presence of inflation. This equation serves the purpose of quantifying this relationship by expressing it as follows: the nominal interest rate equals the real interest rate plus the rate of inflation. In simpler terms, it helps economists and policymakers gauge how inflation affects the true return on investments or loans, providing critical insights for decision-making in the financial and monetary realms. This concept has been a cornerstone in economic discussions and policies, aiding us in comprehending and managing the complex dynamics between interest rates and inflation. (Note: The date “12th December 2019” is unrelated to the topic and has been removed for clarity.)

What Does The Fisher Effect Tell Us About The Bond And Loanable Funds Markets?

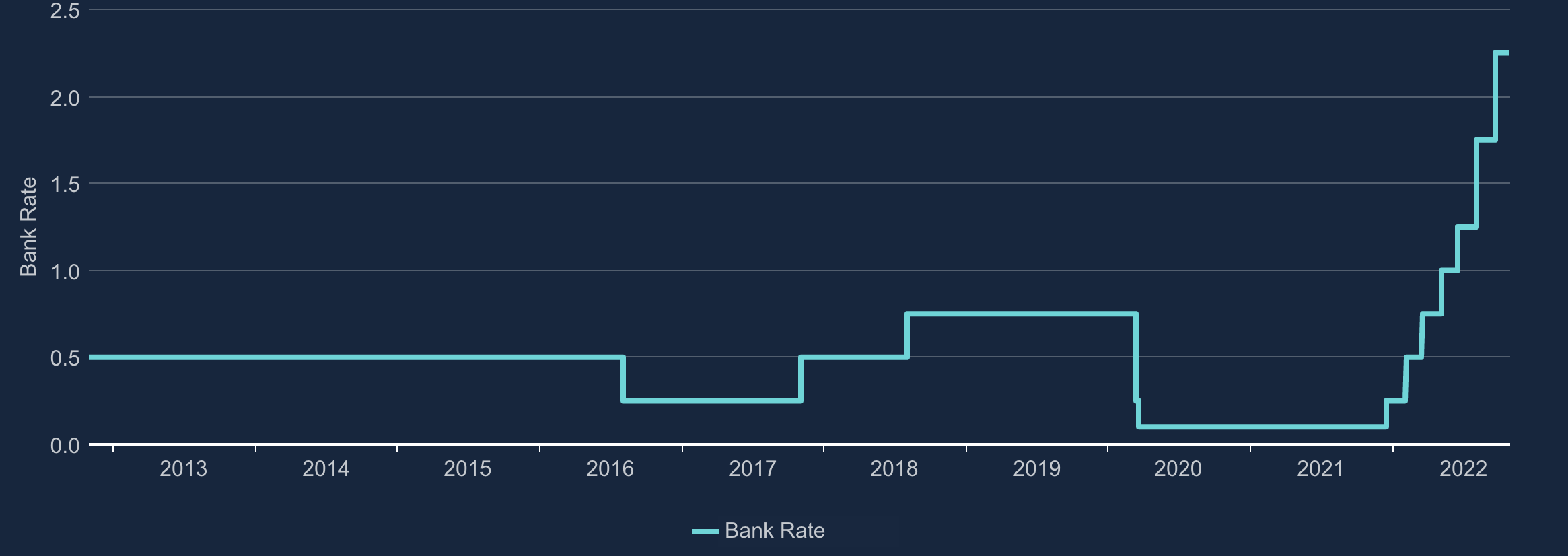

The Fisher effect provides valuable insights into the dynamics of both the bond and loanable funds markets. This economic principle asserts that when there is an anticipation of higher inflation in the future, nominal interest rates will rise by precisely the same magnitude as the expected inflation rate. However, it’s important to note that expected inflation does not influence the quantity of loanable funds available in the market, nor does it affect the real interest rate. In essence, the Fisher effect primarily explains the relationship between expected inflation and nominal interest rates, shedding light on how changes in inflation expectations can impact the borrowing and lending landscape without directly altering the supply or demand for loanable funds or the real interest rate.

Aggregate 35 What is Fisher effect used for

:max_bytes(150000):strip_icc()/realinterestrate.asp-final-9a1778bfb52748c798d30b2e2411f446.png)

Categories: Share 94 What Is Fisher Effect Used For

See more here: tfvp.org

The Fisher Effect is a theory describing the relationship between both real and nominal interest rates, and inflation. The theory states that the nominal rate will adjust to reflect the changes in the inflation rate in order for products and lending avenues to remain competitive.The Fisher equation is a concept in economics that describes the relationship between nominal and real interest rates under the effect of inflation. The equation states that the nominal interest rate is equal to the sum of the real interest rate plus inflation.The Fisher effect states that an increase in expected future inflation will increase nominal interest rates by exactly the amount of expected inflation. Expected inflation will have no impact on either the quantity of loanable funds or the real interest rate.

Learn more about the topic What is Fisher effect used for.

- Fisher Effect Definition and Relationship to Inflation

- Fisher Equation – Overview, Formula and Example

- Lesson summary: the market for loanable funds – Khan Academy

- The Yield Curve And Inflation Expectations

- Fisher Effect – Explained – The Business Professor, LLC

- International Fisher Effect (IFE): Definition, Example, Formula

See more: blog https://tfvp.org/category/science