What Is Risk In Capital Budgeting: A Comprehensive Guide

Risk In Capital Budgeting Chapter 12

Keywords searched by users: What is risk in capital budgeting corporate risk in capital budgeting, what is risk and uncertainty in capital budgeting, What is risk, The relationship between risk and capital budgeting, simulation analysis in capital budgeting, enumerate the methods for accounting for risk in capital budgeting, Market risk is also referred to as, Discuss the different aspects of risk

Why Risk Is Important In Capital Budgeting?

Why is Risk Analysis Crucial in Capital Budgeting?

Risk analysis plays a pivotal role in capital budgeting, and understanding its significance is essential for making informed decisions in business investments. Capital budgeting involves evaluating various projects, each with its unique set of costs and potential returns. However, the inherent uncertainty and unpredictability in future outcomes make it imperative to incorporate risk analysis into the decision-making process.

Investment decisions in capital budgeting are essentially actions taken in the present that will shape an organization’s financial future. The outcomes of these decisions are often unforeseen and can have a profound impact on a company’s financial health. To address this inherent uncertainty, it is essential to assess and manage risks associated with different projects.

While risk analysis can be costly and time-consuming, it should not be overlooked, especially in cases of costly and strategically significant projects. The cost of risk analysis is a worthwhile investment when compared to the potential consequences of making uninformed decisions. By thoroughly evaluating and understanding the risks involved, organizations can better prepare for the uncertainties of the future and make more confident and profitable capital budgeting decisions.

What Does Risk Mean In Capital Market?

What is meant by risk in the context of the capital market? Risk refers to any element of uncertainty associated with your investments that carries the potential to adversely affect your financial well-being. This uncertainty can arise from various sources, one of which is market conditions, commonly referred to as market risk. Market risk encompasses the possibility that the value of your investments may fluctuate, either increasing or decreasing, due to the ever-changing dynamics of the financial markets. However, it’s important to note that risk in the capital market can originate from other factors as well, such as economic conditions, company-specific events, or even geopolitical developments, all of which can have significant implications for your investment portfolio.

What Are The Risk And Uncertainty In Capital Budgeting?

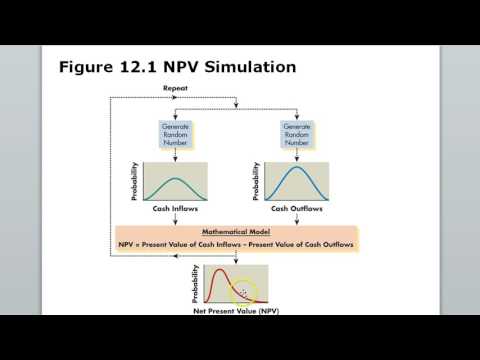

Capital budgeting involves assessing potential risks and uncertainties associated with investment decisions. In this process, one must project future cash inflows and outflows, which inherently carries an element of unpredictability. The future is inherently uncertain, as it’s impossible to predict demand, production levels, selling prices, costs, and other critical factors with absolute precision. Therefore, when making capital budgeting decisions, it’s essential to account for these uncertainties and potential risks to make informed choices that align with the organization’s financial goals and objectives.

Details 12 What is risk in capital budgeting

Categories: Share 74 What Is Risk In Capital Budgeting

See more here: tfvp.org

Generally, business risk means spending company funds on a project, or investment, that may or may not yield revenue. With risk in capital budgeting, the term means the calculation of potential financial variability in revenue from a project or idea.Since risk analysis is costly, it should be used relatively in costly and important projects. Risk and uncertainty are quite inherent in capital budgeting decisions. This is so because investment decisions and capital budgeting are actions of today which bear fruits in future which is unforeseen.Risk is any uncertainty with respect to your investments that has the potential to negatively impact your financial welfare. For example, your investment value might rise or fall because of market conditions (market risk).

Learn more about the topic What is risk in capital budgeting.

- What Is the Role of Risk in Capital Budgeting?

- CAPITAL BUDGETING – RISK ANALYSIS – Taxmann

- Risk | FINRA.org

- Risk and Uncertainty In Capital Budgeting – B Com PDF Download

- Capital budgeting decisions and risk management of firms in the United

- How to Mitigate Project Risk in Capital Budgeting – LinkedIn

See more: https://tfvp.org/category/science blog