Who Bears The Burden Of Loan Interest Payments?

How Principal \U0026 Interest Are Applied In Loan Payments | Explained With Example

Keywords searched by users: Who pays interest on a loan Interest rate la gì, Pay interest là gì, Lending interest rate là gì, Interest money là gì, Deposit interest rate, Loan Interest là gì, Simple interest, Nominal interest rate là gì

Who Pays For Interest Rates?

Understanding Interest Rates and Their Implications

Interest rates are a crucial aspect of borrowing money, as they represent the cost associated with taking out a loan. When you borrow money from a lender, you not only repay the initial loan amount but also an additional sum called interest. This interest serves as the lender’s reward for providing you with the funds. Essentially, it is the compensation they receive for allowing you to use their money for a specified period.

In the realm of interest rates, there are two key players: the borrower and the lender. The borrower, often an individual or a business, seeks financial assistance and agrees to pay back the principal amount borrowed along with interest. The lender, on the other hand, is typically a financial institution such as a bank or credit union. They provide the funds to the borrower and, in return, earn a profit through the interest charged on the loan.

So, who pays for interest rates? Both parties are involved in the process. The borrower pays interest as a cost of borrowing, while the lender receives interest as a form of income. This interplay between borrowers and lenders helps fuel economic activity by facilitating access to capital, enabling individuals and businesses to finance various endeavors, from purchasing homes to launching new ventures.

Is Interest Paid By The Borrower?

Interest, in the context of borrowing money, is a cost incurred by the borrower for the privilege of using funds borrowed from a lender. This expense is essentially a fee paid by the borrower to compensate the lender for lending them the money. The calculation of interest is based on a predetermined percentage of the outstanding principal balance of the loan, typically expressed as an annual percentage rate (APR). This means that borrowers are required to pay a portion of the borrowed amount on top of the principal, representing the cost of borrowing, as they repay the loan over time. In summary, interest is a financial charge that borrowers pay to lenders, and its amount is determined by a percentage of the loan’s remaining balance, making it an essential component of the overall cost of borrowing.

How Is Interest Paid On A Loan?

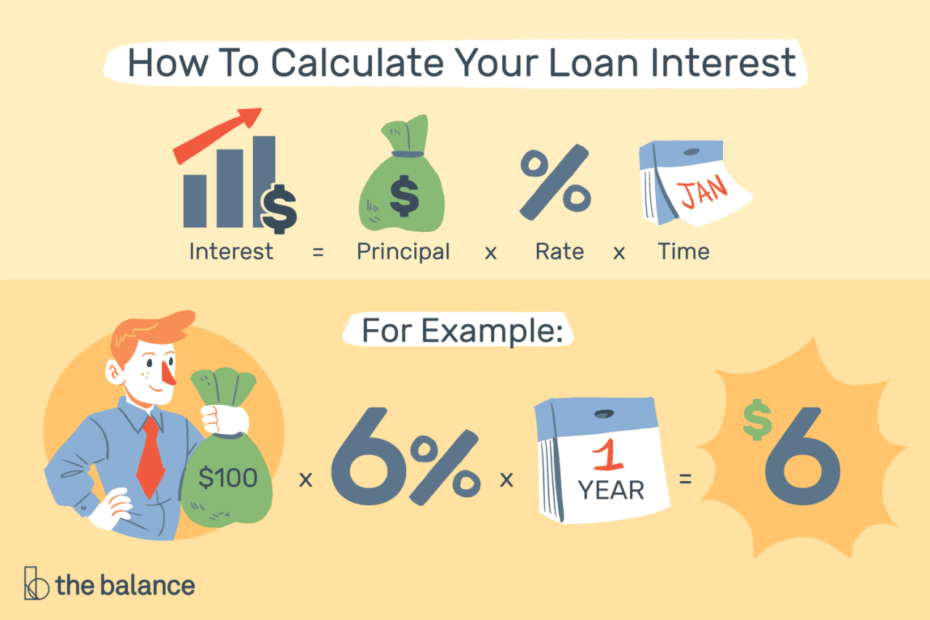

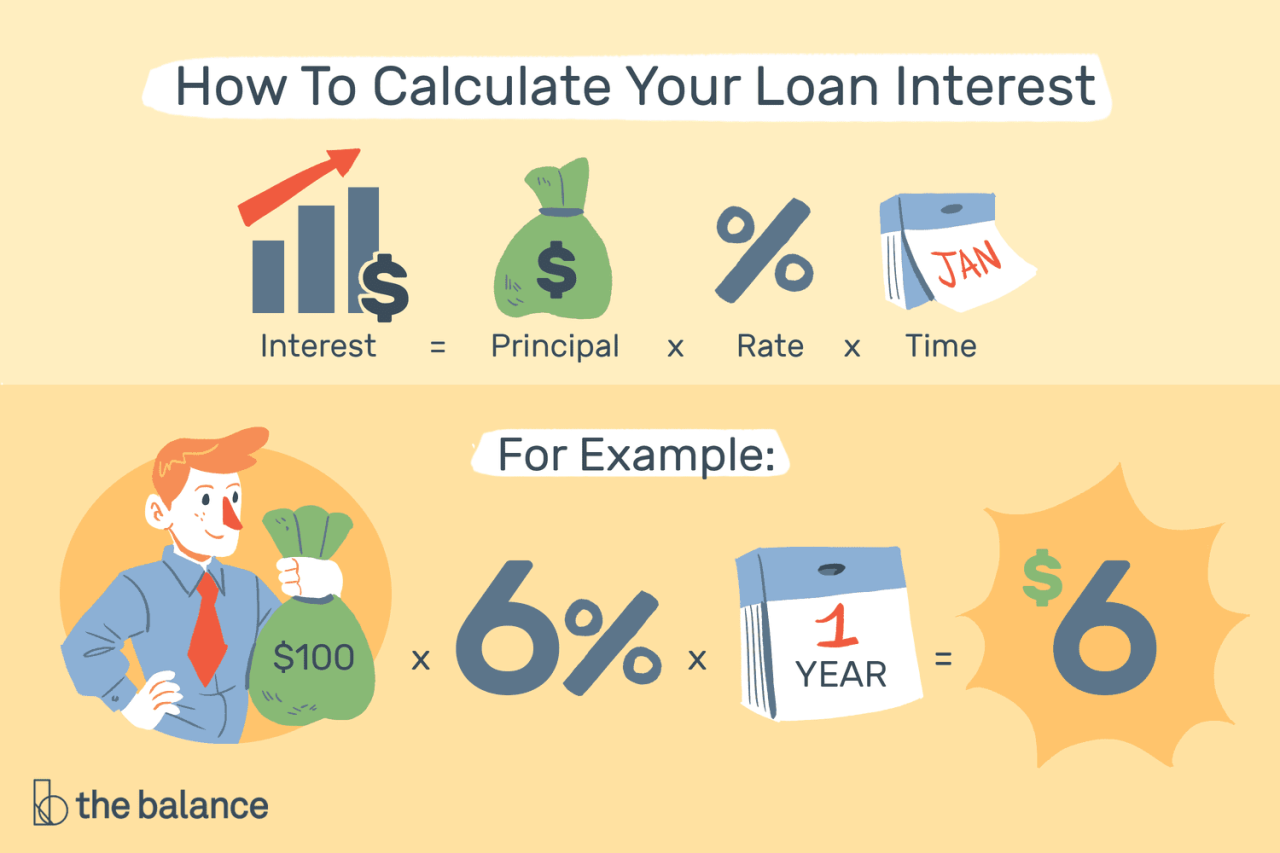

Let’s demystify how interest is calculated and paid on a loan. When you borrow money, repayment typically occurs in one of two ways: you can either repay the entire borrowed sum as a lump sum by a specified date or make regular, scheduled payments over time. The key component to understand is the interest rate, which is a crucial factor in the loan equation. This rate is a reflection of the cost of borrowing for you as the borrower and serves as the return rate for the lender. It’s important to note that the interest rate is applied to the principal amount of the loan, which represents the initial sum you borrowed. In essence, it’s the price you pay for the privilege of using someone else’s money for a specific period. So, whether you’re taking out a mortgage, a car loan, or a personal loan, the interest rate plays a pivotal role in determining the total cost of your borrowing and how you’ll pay it back.

Update 17 Who pays interest on a loan

:max_bytes(150000):strip_icc()/interest.asp-final-c3fdffd368294a708ea21ff11cd4df06.png)

:max_bytes(150000):strip_icc()/dotdash-how-can-i-tell-if-loan-uses-simple-or-compound-interest-Final-17d192dbebc1467cad0e73f776fa7ffd.jpg)

:max_bytes(150000):strip_icc()/what-are-interest-rates-and-how-do-they-work-3305855-FINAL2-2f4b8e003d8d475fa79182d2a5cd4aa4.png)

:max_bytes(150000):strip_icc()/calculate-monthly-interest-92709ed0edc6470380a4444e2aecc37a-c5aa9207689c418da774c116afe62227.png)

Categories: Top 62 Who Pays Interest On A Loan

See more here: tfvp.org

Whenever you borrow money, you are required to pay that base amount (the principal) back to your lender. In addition, you will be required to pay your lender the interest, which is typically an annual percentage of the principal, set for the loan.Interest is the price you pay to borrow money. When a lender provides a loan, they make a profit off of the interest paid on top of the original loan amount.Interest is a loan expense charged for the use of borrowed money. Interest is paid by a borrower to a lender. The expense is calculated as a percentage of the unpaid principal amount of the loan.

Learn more about the topic Who pays interest on a loan.

- What Is Interest? Definition, How It Works, Examples | Bankrate

- What are Interest Rates & How Does Interest Work? – Credit.org

- Interest – Federal Student Aid

- Interest Rates: Different Types and What They Mean to …

- How Does Interest Work on Savings Accounts? – First Republic

- How Savings Account Interest Rates Are Determined – Investopedia

See more: blog https://tfvp.org/category/science