Why Do Rising Rates Hurt Growth Stocks: Uncovering The Impact

Why Do Rising Interest Rates Hurt Growth Stocks? [Vug, Tsla]

Keywords searched by users: Why do rising rates hurt growth stocks How fed interest rates affect cryptocurrency, Why Fed increase interest rate, How interest rate affect inflation, Interest rate affect crypto, Fed increase interest rate effect on stock market, Interest rate affect investment, How inflation affect stock market, What affect stock price

Why Are Stocks Rising After Rate Hike?

Why do stocks tend to rise even after a rate hike? To understand this phenomenon, we need to consider several key factors. First, the extent and timing of rate hikes are crucial determinants. Second, it’s important to account for investor expectations. The Federal Reserve typically raises interest rates during periods of robust economic growth. Interestingly, this is often when stock markets are performing strongly. In essence, the relationship between rate hikes and stock market behavior is intertwined with economic conditions and the confidence of investors.

Why Do Tech Stocks Fall When Interest Rates Rise?

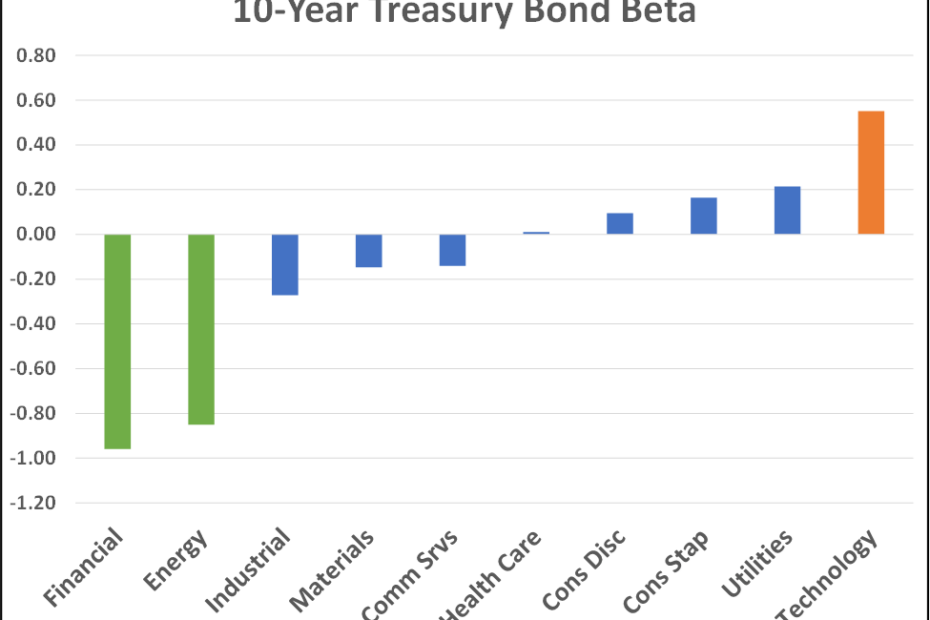

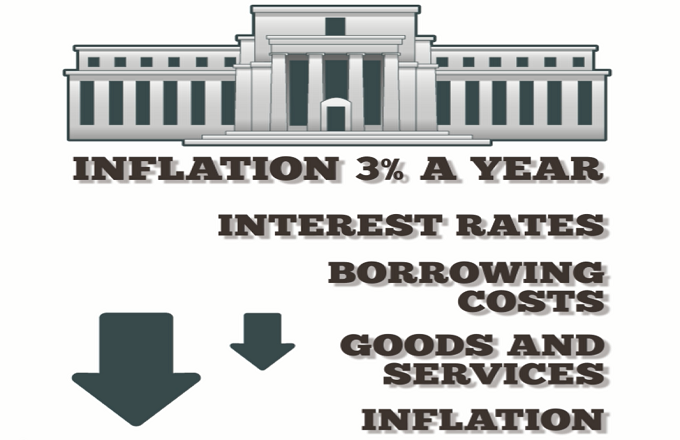

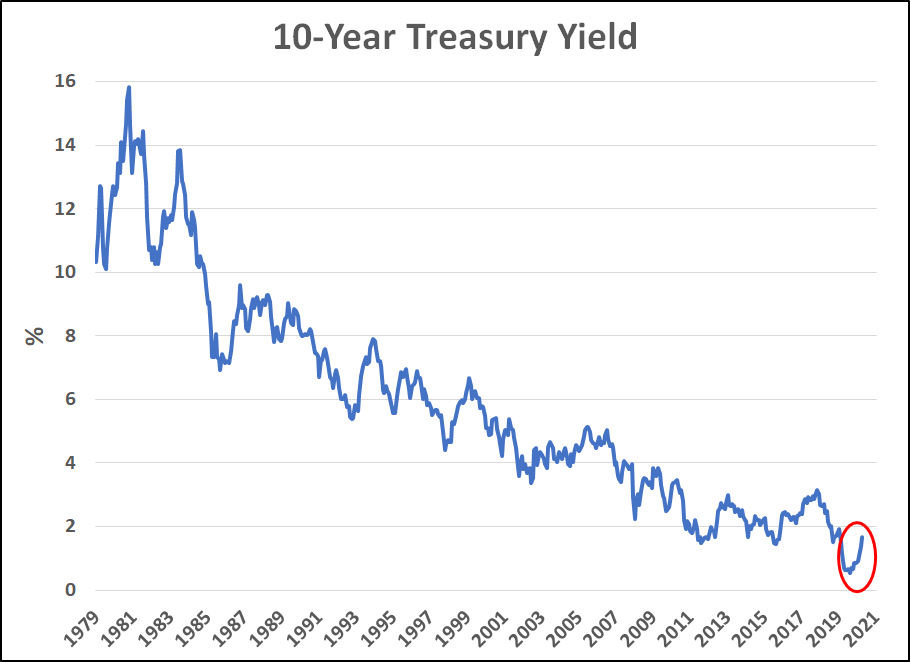

Why do tech stocks tend to experience declines when interest rates rise? This phenomenon occurs because higher interest rates can have a detrimental impact on technology companies. These firms typically rely on substantial borrowing to fund their operations and investments in research and development. Consequently, when interest rates increase, the cost of borrowing for tech companies rises, which can reduce their profitability. It’s important to note that while there is a correlation between rising interest rates and declining tech stock performance, the relationship is not always straightforward or immediate. Various factors, such as the overall economic environment and investor sentiment, can also influence how tech stocks respond to interest rate hikes. (Published on April 26, 2023)

Details 40 Why do rising rates hurt growth stocks

Categories: Update 75 Why Do Rising Rates Hurt Growth Stocks

See more here: tfvp.org

![Why Do Rising Interest Rates Hurt Growth Stocks? [VUG, TSLA] Why Do Rising Interest Rates Hurt Growth Stocks? [VUG, TSLA]](https://i.ytimg.com/vi/PeMUGvu0Qw4/hqdefault.jpg)

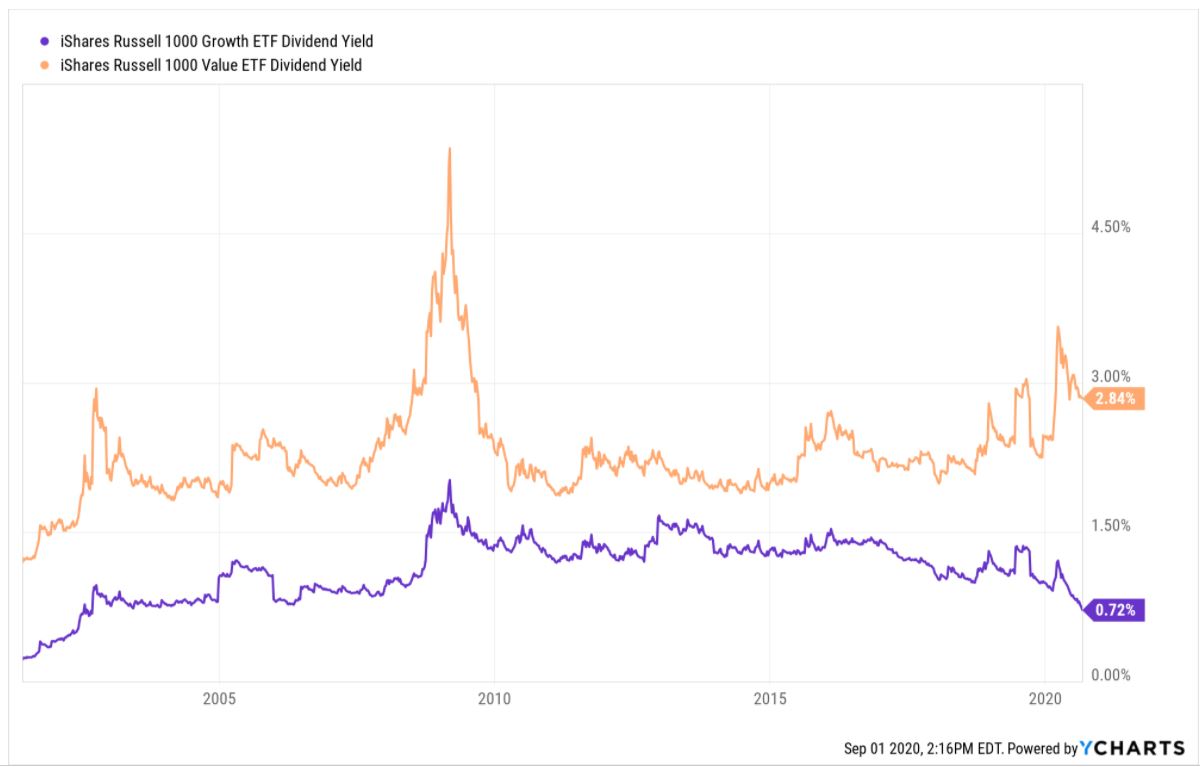

This is because long-term interest rates force growth stocks, which tend to have longer-term cash flow horizons than value stocks, to be more heavily discounted. As a result, growth stocks appear less valuable.The degree and timing of rate increases as well as investors’ expectations also play a role in driving the stock market’s reaction to increasing rates. The Federal Reserve typically raises rates in periods of stronger economic activity, which is when stocks are also doing well.

Learn more about the topic Why do rising rates hurt growth stocks.

- Ahead of the curve: Will rising rates see value stocks win?

- Rising Interest Rates: Good or Bad for Stocks? – Sit Mutual Funds

- Why Do Tech Stocks Go Down When Interest Rates Rise? – Nasdaq

- How Do Interest Rates Affect the Stock Market?

- How do rising interest rates affect the stock market?

- Why rising rates won’t derail stocks

See more: blog https://tfvp.org/category/science